Are brokers going broke?

The fascinating world of Medicare brokers - a $20bn+ industry ripe for disruption!?

Have you watched TV lately? I don’t mean ads-free streaming services or targeted-ad YouTube. If you have watched plain old cable TV, you probably have realized that every second ad is about Medicare. “Get your $0 plan now! (incl. drugs)”. Happy annual enrollment period!

In 2022, 28 million people were enrolled in a Medicare Advantage plan, 48% of all Medicare beneficiaries. This share has grown from 35% only five years ago. But why are more and more people choosing Medicare Advantage plans over traditional Medicare? Medicare Advantage makes sense for a lot of people, especially people that tend to be healthier or that have lower incomes. Medicare Advantage (MA), with its $0-premium plans, is often a more affordable option for many people. But there is another reason - MA growth is fueled by a well-oiled broker machine that pushes MA plans out into the world. There are over 130,000 health insurance agents in the US, and probably a good chunk of them are agents selling Medicare.

The Medicare broker industry is fascinating, and today, I want to dive into the ins and outs of this space and look at some interesting trends. And I’ll give my opinion on how this industry will develop. Stay tuned…

The basics of Medicare brokering

Medicare is complex - when you turn 65, you will receive a 128-page manual that describes the different coverage options you can choose. Overall, people can choose between either A) traditional “fee-for-service” Medicare (the government pays 80% of all eligible services) or B) a Medicare Advantage plan, which is a bundled plan including out-of-pocket maximums, drug benefits, and often additional benefits such as vision and dental coverage. However, this is where the simple choices stop. There are special needs plans, plans for dual eligible (i.e., people eligible for Medicaid), people who choose traditional Medicare can opt-in to buy a Medigap insurance plan to cover the 20% coinsurance, and Medicare Advantage plans offer a variety of supplemental benefits! It is a confusing process. Most people are just overwhelmed, and there is definitely a need to help people choose the right plan. In most cases, brokers fill this important role.

Medicare brokerage offers quite an attractive business model. Brokers are not only paid a commission when they enroll a member into a plan, they also get an additional commission every year the member renews the plan. Most brokers receive about $600 when a member enrolls into a MA plan and then $300 every year they reenroll in the plan. These numbers are the maximum commission that health plans are allowed by CMS to pay to brokers.

But it wouldn’t be health care if health plans did not find a way to add additional incentivize for brokers. In addition to commissions, they pay broker firms - also called field-marketing organizations (FMOs, more on this in a second) - something that is called an override, basically reimbursement for any overhead costs of about $200-$300. Larger broker firms then also can get marketing dollars from health plans so that they can push more generic marketing materials into a certain market.

To understand the industry structure better, let’s have a brief look at what the main players are:

Independent Agents: To sell Medicare Advantage plans, one must obtain a state-broker license and follow all CMS rules regarding Medicare marketing and communications. These agents work for themselves, i.e., they don’t have an employer and live off the commissions they bring in. This can be a lucrative business if you can build a substantial book of business - remember, the broker will get commissions as long as their clients stay enrolled into the plan they enrolled with the brokers.

Brokers will be responsible for generating leads for their health plan contracts - a common way is to buy “Turning 65” lists and send out mailers. There are pretty tight rules around what brokers can and can’t do. For example, they cannot cold-call leads or solicit them in public spaces (like a supermarket or mall).

Field marketing organizations (FMOs): In most cases, independent agents are affiliated with an FMO. These firms build contracts with insurance carriers and offer tools for agents to enroll members and get rates from health plans. They also help brokers with compliant marketing materials and sometimes offer lead support. It is free for brokers to join an FMO. The FMOs make their money from the previously discussed overrides, i.e., they receive $100-$200 from the health plan for every member that one of their affiliated brokers enrolls. In addition to that, they get “marketing dollars” from plans to cover certain marketing initiatives.

Medicare broker agencies: Unlike FMOs, Medicare agencies employ agents as W-2 workers. The commission from the health plan is paid out to the agency, which then pays the brokers a salary (and most likely a performance bonus). They can also collect an override and marketing dollars from the health plan.

Recent Trends in the brokerage industry

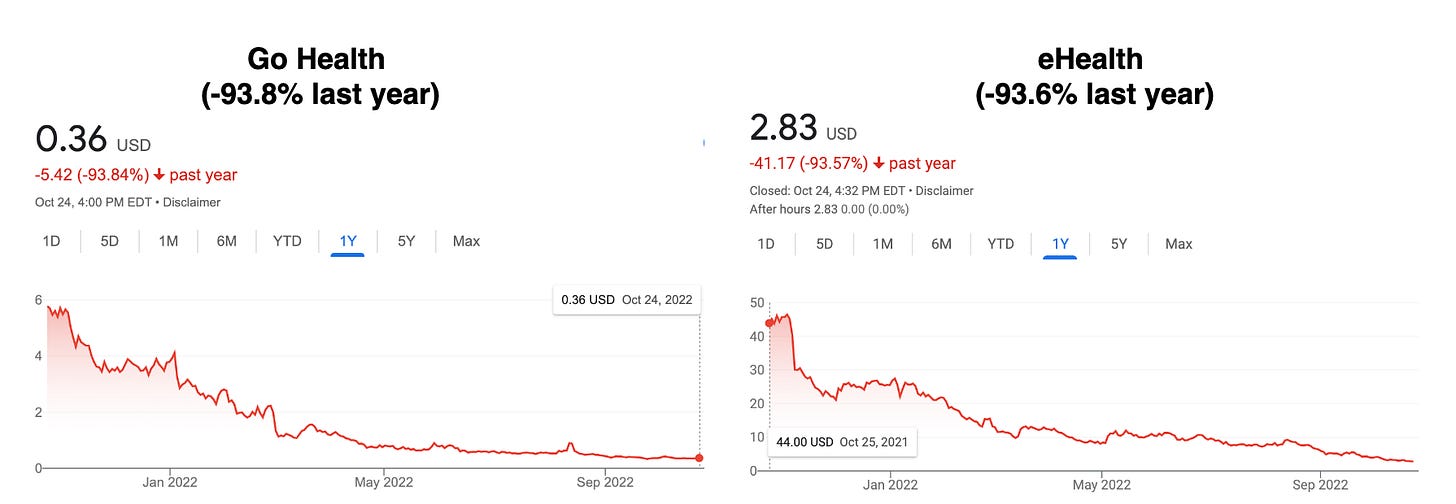

In the last year, we have seen some drastic developments in the broker space: The two public MA brokerage firms got crushed in the public markets - which might initially seem surprising, given the macro trends of an aging population and the growing demand for MA plans.

But there are a few immediate trends that are causing their abysmal stock performance, besides the general market drawback:

Retention rates and short-term disenrollment rates (basically, a member can leave a new plan within 90 days of coverage start) have increased, which hurt the company's expected LTV. For those publicly traded brokers, LTV is measured at the time when they enroll a member.

At the same time, the CAC has increased substantially. For eHealth, the CAC has increased from $685 in 2019 to $906 in 2021 - a 32% increase. GoHealth does not list these numbers in its annual report, but they are probably quite similar.

If both things happen simultaneously, this is the perfect storm that leads to substantial cash-flow problems. CACs occur before the member enrolls in the plan, and there can be quite a lag between paying for marketing and other expenses. In addition, if you have unexpectedly high-disenrollments, payers will claw back the paid commission. Disenrollment can be hard to predict, which makes it hard to predict how much these firms should invest in customer acquisition. It looks like in the last few years, the CAC investment has not paid off.

What is happening here?

But if MA membership growth is a fixture of US Medicare and more digitally adept people are aging into Medicare, why are LTVs and CACs so out of balance? Here are some of my guesses:

Fierce health plan competition elicits shady sales tactics: more and more plans offer $0 premiums, and health benefits are becoming less differentiated between plans. However, plans are starting to entice people by adding ancillary benefits to their plans. Some are quite standard, such as dental or vision benefits, but others are more creative, such as OTC drug cards, transportation services to doctor appointments, or even debit cards to buy healthy food. However, to access these benefits, you often need to read the fine print, as in many cases, only certain people with certain health conditions are eligible for these benefits. This did not stop broker firms, however, from praising the new benefit offers to their prospective clients and encouraging them to switch plans. CMS is quite aware of this practice of “malicious” marketing and now requires brokers to record their phone conversations with prospective clients. Still, competition between health plans will most likely increase plan-switching behavior.

Online CACs are rising: This trend is true for any DTC brand selling through online acquisition channels. More and more firms are bidding for the same ad spots. The recent changes by Apple to protect users’ privacy have made targeting even harder, and conversion rates of online ads have fallen. This trend is particularly impacting those MA brokers that acquire most of their customers online (eHealth, GoHealth, etc.). But also, other “scalable methods” for lead acquisitions, like mailers and TV ads, don’t have fantastic conversion rates. A certain level of fatigue sets in if a person receives the 10th MA mailer in that week. Or do you ever open all these credit card offer letters?

Health plans direct sales: Traditionally, the national health plans (Blues, United, Centene, Aetna, Humana, etc.) have been leaning heavily on regional brokers who own relationships in the local communities. As COVID upended a lot of the personal sales and these brokers reverted more to online and telephonic channels, the argument for these national health plans to work with door-to-door agents got less strong. This, in conjunction with the spreading misinformation about plan benefits and thus declining lead qualities, has prompted these plans to start building up their own DTC sales teams. In fact, on their latest investor day, Humana announced that they would start to invest heavily into their own online and agent sales channels after disappointing results of their broker channels. This is putting direct pressure on MA broker firms.

While the incumbents are being crushed, new players are ready to eat their meal

The sheer size of the MA broker market and overall attractive business model (= annuities) has encouraged quite a few new startup companies to enter this field and try to innovate the rather old-school way of selling health plans to the elderly. Here are some of the strategies these players are pursuing:

Navigate the evolving complexity of plan benefits: Many old brokers don’t cover all health plans but only a selection of carriers they contract with. A range of new firms is offering a complete set of plan choices. In addition, they are adding more decision support to make it easier to match a health plan to a beneficiaries preferences. Members have different needs regarding their provider network, the drugs they take, the ancillary benefits they value, and their financial situation. These players focus on aggregating all the plan information and help with better, personalized decision support.

Engage members throughout the year: Another strategy of the new players is to stay connected with their members throughout the year so that even if a member wants to change their health plan, they will be there to advise them on this decision. Some brokers are layering care navigation services and better client support tools to build more long-term relationships with their clients.

Neo-FMOs: FMOs are pretty old-school organizations, and several startups are trying to build better FMOs. This includes better-quoting tools, more transparency about plan information, and offering white-label engagement tools (such as a website or a mobile app). This is a competitive space, though, as FMOs typically are free to the participating independent brokers, and they can freely switch between their affiliated FMOs.

Offer additional services to health plans: Brokers are in quite an interesting position as they are the first person in the member’s journey when they enter a MA plan. They collect valuable data about a person's medical and financial needs, which can be very valuable for health plans. They also have a “warm” relationship that can be leveraged to offer the member a better onboarding relationship with health plans. A few brokers are trying to use this relationship to sell additional services to health plans, like benefit activation (which can increase member retention), health risk assessments, and even setting up and conducting home health visits based on the data collected during the sales process.

Offer additional services to providers: In the same way, brokers are the first step in the health plan member journey, they can also be the first step in the member journey for value-based care providers (primary or specialty care). Brokers can help their clients take advantage of the right VBC programs or provider groups in their new plan’s network. This is a new line of business that people don’t like to talk too much about, as one has to be careful about anti-kickback laws. These prohibit any provider organization that takes Medicare patients from paying for patient referrals. However, it seems that there are ways how these arrangements can be structured in a compliant way.

Find new acquisition strategies: Being a broker is about finding leads and converting those leads into sales. New entrants are becoming quite creative here in leveraging different channels to get in front of potential clients. For example, MA brokers leverage financial advisors, employers, and other organizations to help them find new leads. If you find a less competitive channel that works, this alone can be the foundation of a good brokerage business.

The winner takes it all?

I find a lot of these new broker approaches quite exciting. Nevertheless, it is a very competitive market, and I do not believe there will be one winner emerging. Here are a few of my thoughts on why:

Can brokers build a “distinct brand” from the health plan: To increase the broker LTV retention will be vital, and thus their transactional sales business has to transform into a more relationship-based brand. But building this lasting relationship is not an easy feat. First, the decision of a member to stay with a plan depends on the plan’s quality, and if the plan decides to make any change to its plan, the member might very well leave. Likely, a bad experience with the plan will also affect trust in the broker who recommended it. Second, in a local community and face-to-face setting, it is probably easier to build these lasting relationships. I wonder whether the new broker firms can build scalable, lasting relationships across markets. A key challenge here is that many players compete to be the most complete, informative, easy-to-understand, helpful resource, including the government, which runs Medicare.gov, a very informative website. However, there might be an opportunity here for dedicated concierge agents that build a relationship with their clients.

To aggregate or not to aggregate? In the end, a broker is a salesperson that needs to hit certain quotas. Most of the new broker firms are trying to change the character of this business, though, and they want to be less of a sales agent than a marketplace - an aggregator of demand and supply that matches every client with the right health plan. It remains to be seen, though, whether any new entrants can achieve scale to be truly a “neutral” marketplace or will fall back into old habits of pushing only the plans they get a commission for. In addition, a Medicare marketplace seems not very defensible. While there are many MA plans overall, in each specific market, there are usually only a few dozen. Just collecting information about these plans is not a competitive advantage. This is very different from other online aggregators in the travel or other insurance industries. Thus, the differentiation of a marketplace might lay less in the aggregation of plans than in the user experience of matching with the right plan. But will this be enough to win over the fierce competition?

Catastrophic Risks: Running a business is inherently risky. However, some businesses are facing catastrophic risks, i.e., risks that, if they materialize, will drive the company out of business. Medicare brokers face quite a few of them. For example, being a marketplace is quite challenging for Medicare plans, as health plans are unwilling to work with any broker firm. If they realize a broker always recommends their competitors’ plans, they might pull their contract, and losing one of the big brand carriers can be fatal for a marketplace. Furthermore, CMS increased their oversight of Medicare brokers quite a bit - if a new broker business is built on a loophole of CMS regulations, it can quickly happen that CMS closes the gap and thus steals the basis of the innovation.

A final thought: Even with all these challenges, we will continue to see new broker businesses enter this market. While it might not be a winner-takes-it-all market, we will see many solid businesses going to be built on the need for navigating MA plans and coverage. If you are building in the space, don’t hesitate to reach out for a chat.

I hope you liked today’s article! I plan to write a second part on the topic, focussing on brokers in the commercial health insurance space (small group, large group, self-funded employers). If you want to support me and know a great broker or benefits consultant, please reach out!

You’re right - this one should probably be on there as well…

Would love to connect with you and talk a little more about Trusty.care so you have better understanding.