Breaking Down Health Plan Fees

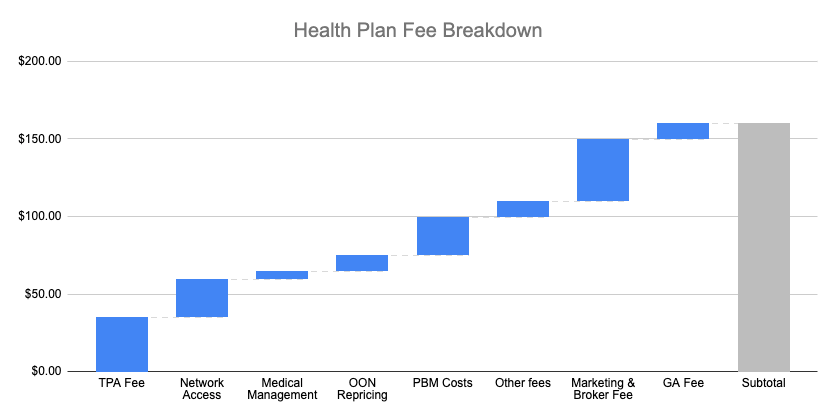

Where a bulk of your health insurance premiums go!

When I am not writing, I am the CEO & Co-Founder of Arlo. We're on a mission to bring affordable health insurance to small businesses across the U.S.—and we need passionate, driven people to help us do it. We want to hear from you if you're excited about using cutting-edge technology to improve a complex health care system! We're hiring Engineers & Sales professionals. Explore our open positions here!

At Arlo, I’m often asked, "Why are your health plans priced so low?" It’s a valid question—after all, sustainable underwriting and not underpricing risk are crucial to avoiding the downfall of carriers like Bright Health and Friday Health.

In this article, I will share our secret sauce: We eliminate the hidden fees that traditional carriers bake into their plans.

A recent Health Affairs study revealed that the big three ASO (Administrative Services Only) carriers—Cigna, Aetna, and Anthem— directly charge employers around $225 per enrollee per year, much more than independent administrators would charge. This is an average number, and you can assume that smaller employers pay much higher fees than larger ones.

But these direct fees are not the whole picture. Beyond these administrative fees, large carriers also generate revenue through their pharmacy benefit managers (PBMs). Furthermore, the ASO carriers are making additional revenue by charging the employers fees categorized as claims expenses, such as visits to provider groups they own, or vendor fees, such as out-of-network repricing fees.

So, how exactly are the administrative fees broken down, and are they truly necessary for running a self-funded (or level-funded) health plan?

In this article, I’ll examine the main components of these fees, including:

Administrative Fees

Medical Management & Utilization Review

Network Access Fees

Marketing & Broker Fees

Vendor Fees

PBM Fees

Fees Disguised as Claims

Understanding Direct Fees in Health Plans

Health plans have several direct fees, which are explicitly outlined and paid on a per-employee-per-month (PEPM) basis. Let’s examine the most common ones and how they impact overall plan costs.

1. Administration Fees ($5-$60 PEPM)

When a company offers a health plan to employees, they will hire a Third-Party Administrator (TPA), which handles the core operational tasks of the plan, including:

Processing, adjudicating & paying claims

Conducting eligibility checks

Managing member service

Handling compliance and reporting

TPA fees can vary widely, typically ranging from $5 to $60 PEPM, depending on their scope of service and the size of the group - large groups get substantial discounts for volume. If a TPA charges a fee below $20, it often indicates that they are cross-subsidizing their revenue through other hidden charges, such as vendor markups or claim-based fees.

2. Network Access Fees ($6-$35 PEPM)

Health insurance runs on provider networks - basically, nobody pays the list price at the doctor, but 95% of the time, they are paying some form of ‘contracted’ rate. Different entities hold these contracts with the providers, and some are renting these contracts to others to access their preferred pricing. The major players—such as Cigna and Aetna— rent their provider network to TPAs as long as they follow their rules. There are also smaller regional networks, such as Midlands Choice and Alliance/Trilogy.

Some players don’t offer a comprehensive network but still offer preferred pricing contracts for certain types of procedures, including:

Surgical bundles (e.g., Carrum Health, Employer Direct)

Cash-pay networks (e.g., Coral, MDsave, Sesame)

Groups must pay network access fees to utilize these contracts, typically ranging from $6 to $35 PEPM. In some cases, these fees are charged as a percentage of claims instead of a fixed PEPM rate (more on that below)

3. Medical Management & Utilization Review ($5-$15 PEPM)

Medical management plays an essential role in ensuring that healthcare services are appropriate and cost-effective. This involves:

Reviewing proposed treatments and medications to confirm medical necessity

Identifying cost-saving opportunities without compromising care quality

Managing chronic conditions and preventive health programs

TPA often outsources these services to specialized vendors, costing $5 to $15 PEPM.

4. Marketing & Broker Fees ($20-$70 PEPM)

To distribute their plans and facilitate sales, health insurers include marketing-related costs. These fees are primarily allocated to:

Broker Commissions: Brokers advise employers on plan options and assist with enrollment. Brokers typically get compensated between $20 to $50 PEPM

General Agency Fees: General Agencies operate like wholesalers, helping carriers reach individual agents and smaller agencies. General agencies compensation usually ranges from $5 to $15 PEPM

Many traditional carriers build these fees directly into their premiums, making it challenging for employers to understand the actual cost of their broker. However, the CAA now requires brokers to disclose their compensation when their clients ask.

5. Additional Vendor Fees (Varies)

Many employers enhance their health plans with additional services that improve member experience and drive cost savings. These services include:

Telehealth providers (e.g., virtual doctor visits)

Specialty Care Programs like - Musculoskeletal (MSK) programs to address back pain and joint issues

Concierge care navigation to assist employees in finding high-quality care

Analytics tools to give advisors and employers insights into spending data

The cost of these add-ons varies widely, depending on the vendor and level of service provided.

6. Pharmacy Benefit Management (PBM) Fees (Varies)

PBMs are a major source of revenue for traditional insurers, and their fees often fall outside the standard administrative costs. Employers typically encounter PBM-related charges such as:

PEPM administrative fees which range between $0-$30 PEPM

Dispensing fees of $3-$10 per prescription

Rebate retention fees, where PBMs keep a portion of manufacturer rebates

Spread pricing, where PBMs charge the plan more than what they reimburse pharmacies

Specialty Pharmacy Revenues: The large PBMs often own specialty pharmacies where they steer members to certain high-cost drugs.

Despite growing pressure for transparency, many large PBMs still include hidden fees that erode employer savings.

7. Stop-Loss Insurance and Risk Premiums (20-30% Load)

Most self-funded plans (including all level-funded plans) include stop-loss insurance to protect employers from catastrophic claims by capping their financial risk. However, insurers charge a risk margin, which represents an additional buffer over the expected claims cost to account for volatility.

Independent stop-loss carriers typically aim for a 70-80% loss ratio, meaning that 20-30% of premiums are retained to cover potential losses and their administrative expenses.

Stop-loss insurers owned by the large ASO carriers often operate at lower loss ratios (80-90%), but they compensate by embedding other fees elsewhere in the plan.

Understanding Indirect Fees in Health Plans

While direct fees are explicitly outlined in a health plan’s cost structure, indirect fees are often hidden within the claims, making them harder to detect. These fees can significantly impact an employer’s overall spending without clear visibility into where their dollars are going.

In many cases, vendors structure their fees in a way that allows them to retain a percentage of the savings they generate. While this can be a performance-based approach, it can also lead to misaligned incentives that ultimately drive costs higher rather than lower.

1. Claims Review & Audit Fees

Errors in medical billing are common, often favoring providers over employers and employees. To combat this, health plans use claims auditing vendors to review bills for accuracy, such as:

Verifying that services were actually provided

Ensuring proper coding was used

Identifying overbilling or duplicate charges

While audits can recover significant savings, vendors typically charge a percentage of the savings identified. Conflict of interest can arise if the TPA performs the claim audit since the TPA may be incentivized to oversee errors in their claim adjudication process and only recover them later for an additional fee.

2. Out-of-Network (OON) Repricing Fees

When employees seek care outside the plan’s network, carriers often employ repricing vendors to set the reimbursement to a more reasonable rate. However, these vendors usually take a cut of the “savings”, which are pegged to inflated benchmarks that don't always align with market rates.

A recent New York Times article highlighted how some carriers use OON repricing as an opportunity to introduce hidden costs, ultimately driving expenses up for employers.

3. International Prescription Drug Sourcing Fees

To combat the rising cost of specialty drugs, some health plans are turning to international sourcing programs, which procure medications at a lower cost from countries like Canada. While this can lead to substantial savings, vendors often charge a percentage of the savings, which may result in fees that are disproportionate to the effort involved in sourcing the medication.

In some cases, employers have found that the fees paid to the vendor exceed the actual cost of the drug, significantly eroding potential savings.

4. Provider Access Fees for Bundled Services

Some organizations offer access to specialized provider networks for services such as:

Surgical bundles

Centers of Excellence programs

Cash-pay provider arrangements

Rather than charging a flat PEPM fee, these vendors may bill employers a percentage of the provider’s billed charges.

5. Subrogation Fees

Subrogation occurs when a health plan pays a claim that should have been covered by another insurance policy—such as workers’ compensation or auto insurance. Specialized vendors recover these payments on behalf of the plan but retain a portion of the recovered amount as their fee. While this can bring valuable recoveries, these fees can add up.

Why Indirect Fees Matter

Indirect fees add complexity to health plan pricing, making it difficult for employers to fully understand their actual administrative costs. These fees often appear under vague categories like "shared savings" or "performance incentives," which can obscure their real financial impact.

Key considerations when evaluating indirect fees:

Alignment of incentives: Are vendors genuinely driving savings, or are they profiting from unnecessary utilization?

Transparency: Are all fees clearly outlined and accounted for in the claims fund?

Benchmarking: Are savings being measured against realistic, market-based benchmarks rather than inflated baselines?

Taking a Holistic Approach to Health Plan Fees

Not all fees are inherently bad—many serve essential functions that ensure a health plan operates efficiently and delivers real value to members. However, the key to sustainable and cost-effective health benefits lies in taking a holistic approach to assessing fees and understanding their true impact on the plan's overall cost.

At Arlo, we carefully evaluate each plan we power, ensuring that every dollar spent contributes to better health outcomes and a smoother experience for both employers and employees. We partner with organizations that are transparent about their fees upfront and charge fees that are aligned with the value they provide.

The healthcare industry is notorious for unnecessary complexity and hidden costs, but we believe it doesn’t have to be this way. By leveraging automation, smarter technology, and operational efficiency, plans can eliminate excessive fees and reduce administrative burdens without compromising the quality of care.

Our mission is simple: to strip out the inefficiencies, focus on what truly matters, and deliver health plans that are lean, effective, and transparent.

If you want to join us on this mission, you can find our open positions here.

For prepay claims review, this can range anywhere from 20% of savings to 40% of savings. Most vendors charge 25% of savings, since most stop loss carriers cap the fees they will reimburse at 25% of savings. Postpay fees are generally 10% to 20% higher, so 35% to 45% of savings. Post pay is harder and many identified dollars are not recovered.

Curious what the typical % of savings charged by claims audit/review in your "indirect cost" section?