Shopping for care - anyone?

Why health care shopping isn't a thing, and how it could become one...

Would you take a $1474 Delta flight from New York to LA over a $642 American Airlines flight? I guess if you are some loyalists with a Delta Platinum credit card you would, but most people won't... Or wouldn't they? Let's look at a different situation: the average hospital based MRI scan for a lower limb costs $1474 on average vs. non-hospital MRI scan for $642. There are almost no difference in quality - the worst that can happen is that the MRI scan needs to be repeated, and then the non-hospital MRI is still cheaper. Yet the data shows, that most people don't compare prices in health care.

But why should they even? Doesn't insurance pay the bill anyways? Not if you are on a high-deductible health plan (HDHP). A high deductible health plan is defines as a plan where the patient has to pay at least $1400 out-of-pocket, before any insurance kicks in - excluding certain preventative care. In return HDHPs usually offer lower premiums and many come with a tax-advantaged health savings account (HSA), but they also shift more risk from the health insurance to the member. In 2019 over 51% of US workers are enrolled into a HDHP.

The economic theory behind these plans predicts that people would be more considerate when choosing health care, as they have to pay a good part of their annual care out of their own pocket. After all when you shop for a new fridge, you would also compare prices, so why having you do the same when you need a colonoscopy? This idea has been hailed as a great measure to realign incentives and to lower overall health care spend. However, this idea seems to have miserably failed. While HDHP were supposed to encourage people to price shop - they seem to more incentivize people to not go to the doctor and delay care. When people go to the doctor, they rarely seek out the most price efficient choice. But why is this the case? Over the last days I read a few studies on health care price shopping and wanted to summarize my findings for you.

Barrier 1: Patient behavior

First, of all: shopping for price efficient care IS the rational choice. But health care seems to be different. Here are some of the reasons:

Money stuff is difficult: It's the same reason why people have overpriced credit card debt and why people don't max out their IRA contributions - many people don't have a good understanding of the financial effects of their actions. This is especially true for health care as not many people know of the crazy price differences that exist for the same type of treatment. Even the insurance negotiated prices in two hospitals of the same hospital network could be vastly different. But there is probably one group that is basically forced to think of their out-of-pocket costs and those are people with chronic conditions. While they might be better in choosing a plan that works for them, they would probably either opt for a lower deductible health plan or meet their deductible anyways so they don't have to think too much about shopping for care.

“My doctor has been my doctor for 30 years”: A main reason why people choose a certain doctor are established relationships. If your family has been seeing a certain provider for decades, it's unlikely you will switch. For a many people it is also very hard to judge the quality of a doctor, so many people fall back on judging the quality by using recommendations and past experiences. Price does not really seem to play a role in these considerations.

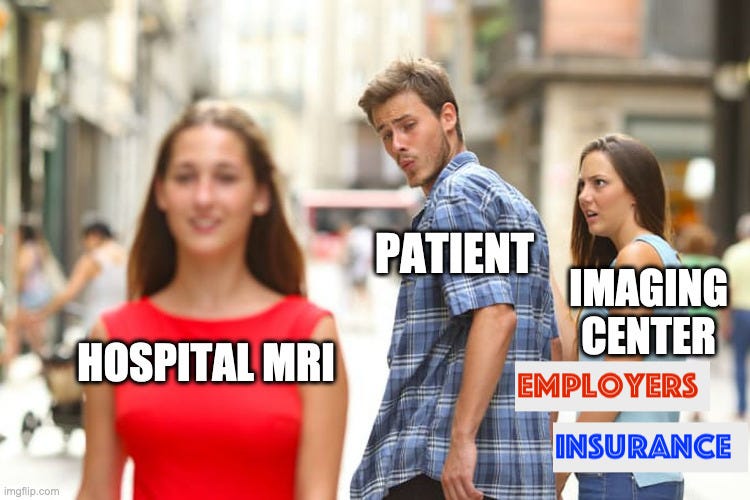

Follow thy doctor: Because physicians are people of high trust, we usually follow their advice. In the end, we will do what the doctor recommends and see the specialist the doctor is referring us to. Trust is extremely important of the health care system to work. However, many doctors often aren’t aware about the financial consequences a referral could have on their patient. And sometimes they are even incentivized to send them to a more expensive provider: Over the last years hospitals have bought up many independent practices to gain control over the referral flow and routing patients to their more expensive facilities.

Treatment bundles: Visiting a doctor usually consists of several "line items" - there will be the consultation fee, diagnostic testing, potentially some blood work, medical images and drug prescriptions. There are quiet some cost savings to unbundle these items from a single doctor to multiple providers, like taking the image in an imaging center or using a certain lab for the blood work. While this is an option in theory, it is inconvenient having to coordinate between different parties (lab, imaging center & physician) and requires proactively speaking up against the doctor to demand a different lab provider. Who does that?

Barrier 2: Existing shopping solutions barely work

So let's say you are one of the 5% "homo economicus" that acts rational and you would like to find the most effective care, what would you do? There are a few options but you will not be impressed. There are two groups who have an incentive for you to be cognizant of prices: Self-funded employers and health insurers. More and more of them provide price transparency tools that help users to find cost effective care.

Employer & Health Insurance Solutions for care navigation

Several vendors & insurers provide price transparency tools to their employes or members. Some examples are:

Sapphire Digital → give cash rewards to employees who shop

Oscar Care Navigator

However, these approaches are not seeing a wide adoption or spending decrease. There are a few reasons for this:

For these tools to work, delivering reliable savings is key. However, not every health care service is shoppable - it's estimated that about 40% of care can be “shopped”. Of these 40%, price shopping also only makes sense for treatments that fall inside the deductible - the list of shoppable services is further reduced if all the more expensive services (i.e. $3000+) are taken out, because they will anyways exceed the deductible and there is not much more incentive to go for a cheaper service afterwards.

Determining costs upfront is not always straight forward and requires sophisticated analytics on the backend to get an accurate price estimate. In particular, the cost of a visit is not only a matter of price for a service but also the quantity. So if a doctor charges less for a visit, but usually does an ultrasound test, it might be better to go to a doctor with a higher consultation charge, but that is less likely to do an ultrasound test.

Lastly, do people trust their employer or health insurer to find you the most cost effective care? Or would you think they are more incentivized to just push you to "cheap" care. How much do they care about quality? Maybe the employer and health insurer are just not the right parties to offer these type of tools. Fun Fact: on study even suggested that price transparency tools can increase health care spending, if people think price is an indicator for quality and will go an get the “premium experience”.

Cash pay networks

A different approach to health care shopping is to ditch insurance all together and pay cash. In some cases this might be reasonable, especially if you have an Health Savings Account and can use pre-tax money and cash rates are better than the insurance rates. There are several companies offering cash pay networks, that should provide price transparency:

Green Imaging for medical images

UberDocs for specialty visits

Sesame care for urgent care & virtual care - targeting a younger audience

K-health - targeting urgent care & primary care

A very superficial look at these websites though makes me less hopeful. Many have a bad user interface and design (how the hell should I know the CPT code for my planned treatment? Linear distance is not an accurate measure of closeness in New York -ever took a bus during rush hour to .5 mile away New Jersey?), the coverage area is very sparse (on many sites I could not find a colonoscopy in New York) and it is difficult to judge quality.

But,… I am not giving up on this. If you know of any great price shopping tools - please email me... (janfelix@substack.com)

But this company managed to get around the barriers....

But then there is one solution, one solution that defies all the issues I mentioned before! It's a $16bn market-cap company that IPOed last year. You probably guessed it: I am talking about GoodRx. GoodRx provides an app where you can search for basically any prescription drug and get a coupon that gives you up to 80% of discount. The discount can be so much that it might be much cheaper to use GoodRx than paying the deductible of your insurance. The catch: GoodRx does not run through your insurance, and therefore does not count towards your deductible. It might still be the cheaper option, especially if it is a one time refill.

But what made GoodRx successful. These are the things that I found critical to their success:

Doctor's love them: In the end most doctors chose their profession to help people - and the most important prescription drug is the one that is picked up by the patient and taken as prescribed. Doctors know that many patients are afraid of the co-pay and don't pick up their meds. GoodRx provides price transparency and gives patients access to cheaper drug prices, which can increase. Also taking the financial situation into account when prescribing a drug builds more trust with the patient. (But shouldn't take that also into account for specialist referrals? 🤔)

Targeting patients with chronic conditions: Many chronic patients are using it... they cannot afford to constantly pay higher bills.

Drugs don't talk: While some people build a special relationship with their drugs, they rarely build one with their CVS pharmacist (didn't mean to offend anyone here - I truly believe CVS pharmacists are lovely people and its not their fault). If the pills come from Wallgreens or through mail, there is no big difference. Also because drugs are more a "commodity" people are used to price shopping and it's also easier to create a price catalogue that has 99% of all drugs available.

The business model works (for now): For any market place that needs to create demand & supply, there needs to be a working business model on the other side of the venture capital funding rounds. By partnering with pharmacy benefits manages & because GoodRx exploits a problem in pharmacy pricing, they can provide drug prices that are cheaper than patient deductibles and keep a percentage for themselves. (If you want to know exactly how GoodRx makes money - hit me up - I have a private post written for those who are interested...)

So the big question is: How can one learn from GoodRx to create a good experience for patients to compare prices and help people choose cost effective care without compromising quality. I would like to explore two approaches:

Price Shopping at the Point of Referral

Cash pay for medical services

Stay tuned for more on this topic...