Sizing the digital health market: How many providers are there really?

The market for digital health infrastructure

Over the last few months, I learned a lot about digital health companies, their business models, and how these providers can be segmented. When I wrote about the Shopify for Health Care, one thought got stuck with me: What does the market size for digital health infrastructure actually look like? How many digital care providers are out there? There are quite a few different numbers out there. Julie Yoo from a16z writes in her original article about the virtual care tech stack that 1000+ digital health startups have been started in the last few years. From other investors, I heard they estimate this number to be closer to 3,000.

But when looking a bit deeper into these numbers, I had some doubts: The a16z article included Oscar and Devoted health, who are health plans, not actual care providers. Also, if you check out all startups tagged with health care on Crunchbase, you will get closer to the 3000 number. However, those companies also include biotech, wellness, and other health IT startups. So I was wondering: how many digital care providers are actually out there. In this article, I will take you on my research tour and share some of the results with you. You can also find the complete list of startups I found on my newly launched website Digital Care Directory.

What is a digital care provider?

To start, I pulled together all my prior research and made a list of every company I have come across. This list was probably highly biased towards my network and media consumption, so I decided to list all data sources containing digital health providers. I collected VC portfolio company lists, filtered Crunchbase, scrubbed the YC list, obtained customer lists of my friend's infrastructure startups, and went through slack channel postings.

It wasn't easy to distinguish actual providers from lifestyle and other health care adjacent companies. So I put forth the following criteria to limit my search and to define a digital care provider:

Patient-facing brand: The company needs to hold a relationship with the patient. I excluded pure white-label solutions but included marketplaces and provider networks that act as the digital front door for the patients.

Virtual-first: The provider needs to pursue a virtual-first approach, and utilize digital channels to support the whole patient journey. I also accepted Hybrid approaches that combine in-person care with virtual care. However, I did not include legacy providers that tacked on telehealth to their practice without changing their care model.

Clinical benefits & operations: The company needs to show clinical value and improve health outcomes. I excluded pure lifestyle products or products with unproven clinical value. While the provider does not necessarily need to employ clinical staff, their product must be embedded in a clinical process and work alongside certified clinical care providers.

So after sifting through all these databases and tagging the providers - here are some of my insights!

Breakdown of the numbers

Overall I found about 350 companies that would qualify as digital care providers. I was able to tag 150 so far, so the data is still quite biased, but here are some preliminary results:

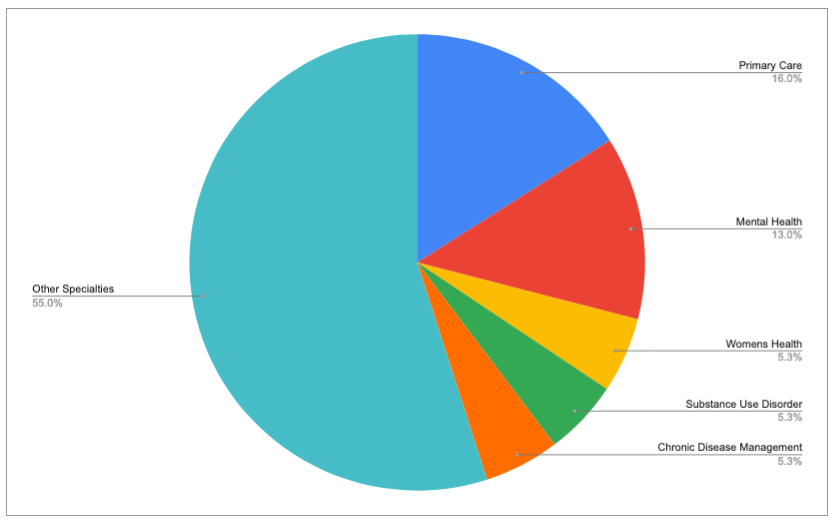

Breakdown by specialties

Primary Care, Mental Health, and Women's Health make up the largest three categories. Note that Mental health, Women's Health, and Substance Use Disorder are specialties that traditionally have inadequate patient access. These categories offer great opportunities for virtual care to fill a gap in the market. Primary care is in the top position (as expected), as many primary care services can easily be delivered online. But care is not only happening online...

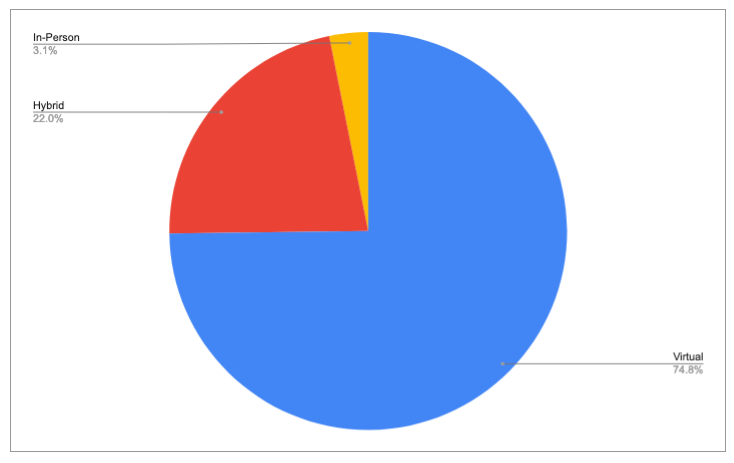

Breakdown by Delivery Type

Most digital care companies adopt a virtual-only approach - about 75% of the sample. However, a sizable chunk is doing hybrid care, and some are even doing most of their care in-person. The in-person companies here are mainly delivering care at home.

Breakdown by Reimbursement Model

Interestingly, only about a third of all providers in the sample are cash pay only. Many providers are also taking insurance or are reimbursed in some other form (as employer benefit, Medicare reimbursable, or provider-sponsored). I would expect the cash-only part of the pie to shrink over time, as early stage businesses will probably move beyond cash pay as they look to expand their revenue models.

Again - please take these results with a grain or better a pile of salt. My tagging is not the most accurate, and there is still a substantial amount of providers left to tag. I will write up my updated results once this analysis is done.

A closer look at the provider categories

After looking at hundreds of digital care websites, it was interesting to see several repeat patterns and business models across the different digital care providers. Here are some common types of digital care providers:

Access to Prescription Drugs: This model is designed to increase access to prescription drugs. A prominent example here is Ro and Hims&Hers with their skincare, ED, and hair loss prescription drugs. Prescription drug models have also expanded in other areas such as psychiatry and substance abuse disorder. One has to be very careful, though, about the incentives for the digital care provider. Do they make money on the drugs and just act as "pill mills," i.e., they will prescribe as many drugs as possible? Or do they care for the patient more holistically and are outcome-focused? The latter providers will also offer other delivery models and choose prescription models only when appropriate. These providers will also supplement any medication therapy with other forms of care.

Primary Care through virtual care: Primary care is ripe for a virtual care model, especially for low acuity visits. For many situations, a 5 min virtual visit and mail-order prescription might be sufficient to help the patient. I really like how texting and video blend in these models, and how data can be used to more efficiently triage patients and coordinate the proper care. The more data these virtual primary care providers can gather, the better they will become in triage and personalized medical experiences.

Well-scoped specialty care for a specific condition: This is probably the type of business I am most excited about - these digital care providers usually have a very narrow diagnosis focus and a well-scoped treatment model. Examples are sublingual allergy care programs or virtual treatment for polycystic ovary syndrome.

Chronic care management programs: These are usually not staffed by doctors but by health coaches and other trained staff. Those types of companies work as a supplement to existing care and make it more efficient. Some include education materials delivered through a virtual program or app, a patient community, and regular check-ins with a health coach or care coordinator.

Virtual Provider Networks: Certain specialties have traditionally been challenging to access. Either because the market is very fragmented or these specialties are generally not covered by insurance (often a result of a fragmented market). Two examples here are maternity / post-partem care and mental health therapists. Several companies are building platforms that allow patients to access providers and schedule appointments with ease. In many cases, these services can also be delivered online.

These are just some examples that caught my attention, and there are many more business models. I probably also missed quite a few original and creative approaches here. Let me know what else should be included here.

Making it a Digital Care Directory

After doing this research (primarily for myself, out of curiosity), I realized that this might be beneficial for the digital health community, so I decided to put this on a website. You can now find the first 150 providers at Digital care.Directory! Here are a few more reasons why I decided to put it on a website:

Digital health is pushing into new applications & they become more differentiated: More and more differentiated specialist solutions are entering the digital health market, focusing on specific conditions and treatments. Digital care is not only virtual consults but spans remote monitoring, digital programs, and at-home visits. When a patient or a doctor is seeking a particular program for enrollment, it is easy to get lost. Thus there should probably be a space where doctors and their patients can narrow down the number of providers to select the most appropriate program. I don't expect this directory to be a "match-maker" that helps patients find the most appropriate care - that can only decide a doctor with all the relevant context, but it might open up new options...

Population & identify specific focus: Digital health providers not only differ in their diagnosis and treatment scope, but they also focus on different populations. Research shows that taking into account the identity and social background of a patient can lead to a stronger provider-patient relationship and improve health outcomes. Again, knowing about these options can help patients & doctors get better outcomes.

Rising acquisition costs: While more differentiation opens up new options for patients, the flip side of more differentiation is higher customer acquisition costs for each provider as they compete for the attention of these patients. A centralized directory might solve this at least a bit, as a virtual cardiologist focusing on the elderly is probably not competing with a hormone therapy care provider targeting LGBTQ+ patients. However, both might bid for the same marketing spots and drive up ad prices. Additionally, digital care providers are likely competing less against each other and more against traditional providers. This directory could drive general awareness about the possibilities of digital care.

The digital care directory is still very much a prototype, and I am planning to add a few features and more providers to the website (there are still 200 left to be added). Please share the provider directory and ask your digital care provider founder friends to add themselves to the website if you want to support this project! Also, don't shy back from any feedback. I am always interested to learn what you think...