The state of telehealth: digital providers, their communication tech stack & future trends

...and why video chat is not what telehealth is about!

The growth of telehealth is mind-boggling! Even crypto-darling Solana cannot beat that growth (since its listing on major exchanges in July). Last week I stumbled across two numbers:

A recent HHS study found that the number of telehealth visits from Medicare-beneficiaries increased 62x in 2020 compared to 2019

While 2020 was an exceptional year due to COVID, a McKinsey study shows telehealth has stabilized at a 38x increase earlier this year.

The growth of virtual health is in a perfect storm fueled by regulatory changes, greater consumer adoption, and new applications for telehealth that go beyond primary care consultations. To support this growth, telehealth providers are adopting different technology stacks. Builder tools, "white label" solutions, and virtual care platforms have emerged that help digital-first and established providers take virtual visits.

So today, let us look at the different types of virtual care providers, what telehealth technology they are using, and what the future of virtual care can look like.

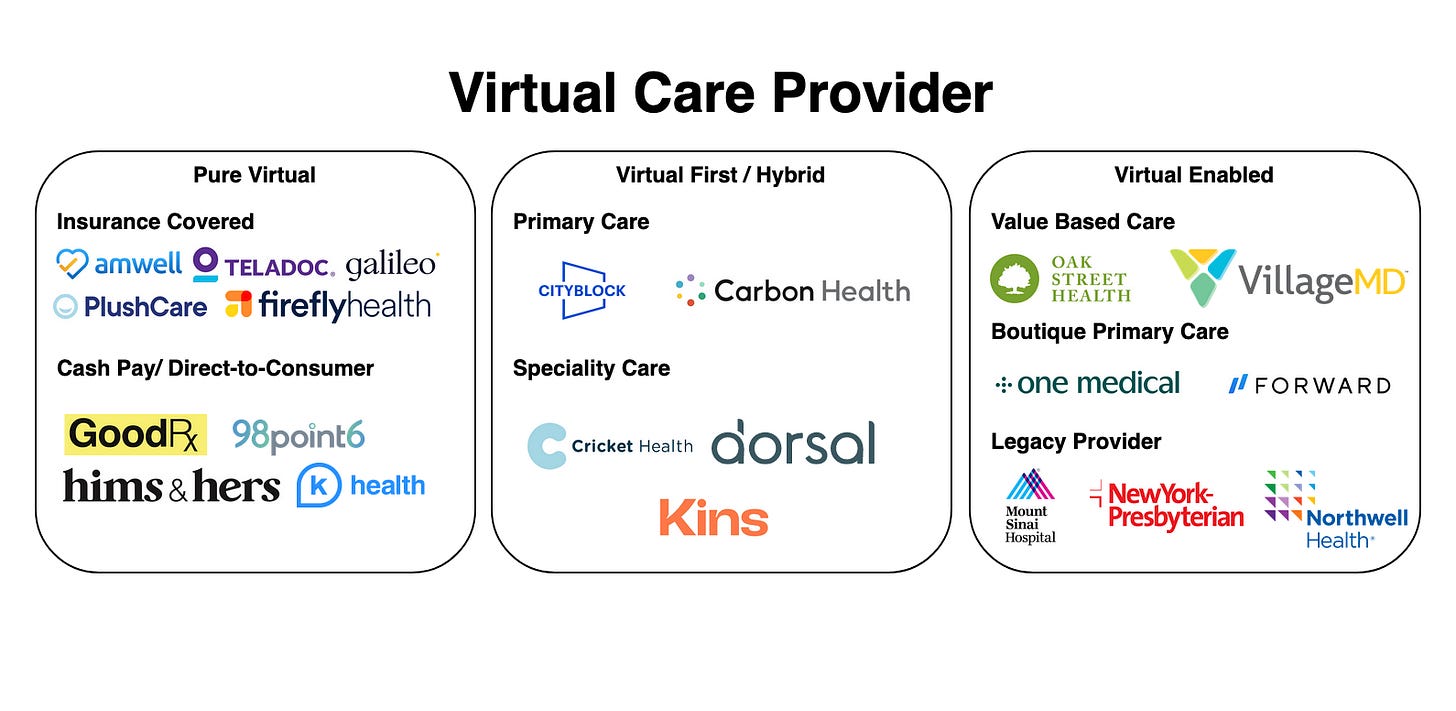

Segmenting Virtual Care Providers

Digital health has become such a buzzword that it is worth defining what virtual health means in this article: I want to focus on providers who use digital channels to communicate with their patients for diagnosis, consultation, treatment, and patient education. I am specifically not looking at the whole world of digital health apps, care coordinators, smart devices, etc.! There is much more to digital health than digital communication, but more on that later.

With this out of the way, there are multiple different forms by which virtual health providers can be segmented:

Synchronous vs. Asynchronous: This is the difference between voice/ video call and chat. In synchronous telehealth, the doctor and patient meet simultaneously (i.e., video, phone). In an asynchronous setting, the doctor will reply whenever available (i.e., chat, messages).

Primary vs. Specialty: Primary care is a great use case for telehealth. Many visits usually involve diagnosing and treating common, well-known illnesses or determining that further testing or a referral to a specialist is needed. But specialty visits are also increasingly done in a telehealth setting, especially for chronic patients, i.e., patients that have an ongoing relationship with their doctor.

Direct-to-Consumer vs. Insurance Covered: Insurance billing is a nightmare. That's why many digital-first companies have decided to streamline their operations and take in cash patients. However, as they are reaching market maturity, they are also starting to enter into the insurance-covered space.

Virtual vs. Hybrid vs. Virtual-Enabled: This is probably the easiest segmentation - some providers are purely virtual, i.e., they only deliver telehealth services, then some providers adopted a hybrid model using virtual visits as their primary way of communicating with patients, but also maintain brick-and-mortar infrastructure to see the patients for in-person visits. In the virtual-enabled category fall businesses who are essentially not virtual but who are using virtual care as a tool to extend their services.

For more ideas on how to segment providers - check the replies on this Tweet:

Let's now look at some of the example providers for each of these segments

Pure Virtual Providers

Telehealth is nothing new, and there are several very well-established players in this market. The big names are AmWell & Teladoc and GoodRx, which recently entered telehealth. By merging with Livongo, Teladoc set itself up to become the major player in end-to-end digital experience for different groups of patients. Teladoc wants to cover diabetes care to primary care and mental health.

However, these public companies have a lot of competition from private players such as Plush Health, Galileo, or Firefly. They try different strategies to capture a part of the market, such as focusing on a specific patient segment or condition.

Another pure virtual player group are direct-to-consumer brands that are not taking insurance (yet). Noteworthy providers here are:

Hims & Hers (started with lifestyle drugs now entering primary care and psychiatry)

Ro Health (also started with lifestyle drugs, currently building a technology stack for digital providers)

98point6 (asynchronous care via chat for cash pay patients)

K-Health (cash pay digital primary care)

In the pure virtual bucket also fall white label solutions such as Wheel. They built a provider network and technology that can be embedded into another digital health service. I will talk more about these in the "tech stack" section.

Hybrid - "Virtual-First": Most interactions with the patients are through virtual care

A lot of medical treatment still does need in-person visits for specific diagnostic equipment and treatment. Therefore, many virtual providers have adopted a hybrid strategy. Patients enter them through a virtual consult, stay in touch with their doctor online, and have in-person visit opportunities. The in-person visit does not necessarily need to happen at a doctor's office but can also occur at home - another important trend to notice. Companies that have adopted this hybrid approach are Cityblock & Carbon Health. Both are primary care providers. But also specialist care is done more and more in a hybrid setting: Cricket Health (Kidney Care), Dorsal Health (Backpain), Kins (Physical Therapy).

Value-based care providers: Providers under a value-based payment model usually adopted telehealth solutions much earlier (podcast with Oak Street Founder). They are less concerned about whether a telehealth consult can be reimbursed but whether they can reach their patient & keep them on their treatment plans. Chats, Video calls, Text messages, and good old telephone have proven effective here. They are widely adopted by VBC providers such as Oak Street Health & VillageMD.

Virtual-enabled

Virtual-enabled telehealth providers see digital communication channels as an addition to their in-person care. Unlike hybrid models, the emphasis is on the brick-and-mortar business. In this category belong providers who added virtual capabilities to their current practice to deal with the growing demand for online consults. A noteworthy group is boutique primary care providers such as One Medical, Forward, and Health Quarters. They need to offer a digital channel as they cater to a younger, wealthy demographic that is willing to pay or gets their employer to pay for the monthly membership fee.

The COVID pandemic meant a lot of revenue lost for many legacy providers, like hospitals and specialty clinics. This revenue pressure caused most hospitals now also to offer virtual visits. All of the major hospital networks in New York City offer now telehealth (Mount Sinai, New York Presbyterian, Northwell)

Also, smaller practices are building video consulting offerings to their existing patients. The AMA published a playbook on how providers can go virtual, and I found it an engaging resource.

What to consider when choosing the stack

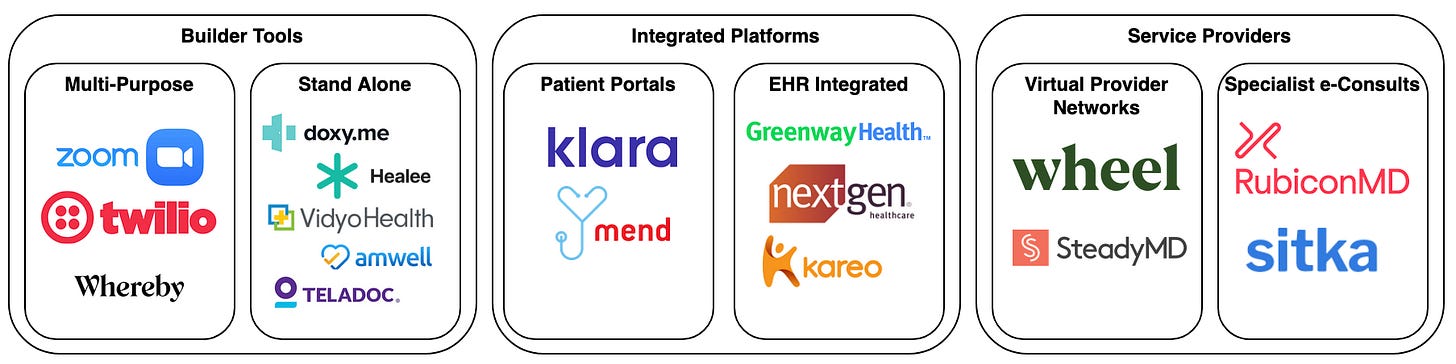

All the providers above have to develop a strategy to build their virtual health capabilities and select a communication platform. Choosing the right platform is not trivial, given that there are a plethora of vendors promising to help their practice to go digital:

Buy vs. Build: These days, this is not a clear cut decision but more a scale - on the one end, there are very basic builder tools, in the middle, there are APIs and white label services that need to be configured and integrated, and on the other end there are "full-stack" solutions that require minimal engineering efforts on the provider side.

Integrated workflows: Digital communication channels alone do not provide better care and might be worse, as a lot of context is lost (as we all should know by working from home for almost two years). Telehealth needs to be integrated into the clinician's workflow, the EHR system, and other IT systems (ideally with other providers) for telehealth to provide a high quality of care.

Regulatory requirements: During the COVID pandemic, CMS has relaxed some of the restrictions for telehealth, but there are still quite a few regulations to keep in mind. In particular, the platform should be HIPAA compliant (for example, through a HITRUST certification) and state licensing requirements need to be fulfilled.

Patient Experience: Clinical communication is only one part of a provider's patient interactions. Other interactions include scheduling, billing & payments as well as data sharing. It makes sense if the virtual visit is embedded into an overall patient communication strategy and not piecemealed together.

Telehealth Solution Providers

Builder Tools

Several companies like Zoom, Twillio, or Whereby provide generic communication platforms that can be embedded into different types of systems and webpages. To use these tools for patient data, they have to be HIPAA compliant, and the provider needs to sign a business associate agreement with the software provider. Note that they charge a much higher amount for HIPAA compliant services than for their enterprise services - I guess because they can.

A level up from these bare-bone utilities are stand-alone telehealth products that allow providers to conduct telehealth visits, such as Doxy.me, AmWell & Teladoc. Many vendors have been pushing into this space since the start of the pandemic. Many offer integrations with EMRs, back-office technology, remote patient monitoring tools, and patient portals. A lot of the core video/ texting functionality comes out of the box. Still, a lot of manual plumbing has to be done for each install.

Integrated platforms

Many independent physicians don't have the resources to build their telehealth practice from scratch or even setup all the integrations, so they are advised to opt for full-stack solutions or expand the software providers they already use. Provider software vendors haven't been sleeping during COVID, and almost all EHR & patient portal platforms have added telehealth modules. I see two routes a provider can go:

They can integrate telehealth into their patient facing application, i.e. their patient portal/ digital front door. This would provide a seamless experience for the patient as they would not have to switch between applications and have all their communication with the doctor in one place. Companies such as Klara and Mend provide a full-stack patient interface.

The other route would be to integrate directly into the physicians’ workflows. EHR vendors such as Greenway and NextGen provide now integrated telehealth modules that can be used within the EHR, so this requires less application switching for physicians and it integrates telehealth with other clinical workflows, like prescriptions and referrals.

Service Providers

Sometimes bare technology alone might not fit the need for a provider. There are companies that provide the technology, and also a network of providers that can take the visits. These provider networks can be white-labeled and will act as if they come from the doctors office. The leading players here are Wheel and SteadyMD. These provider networks are especially useful for providers that want to scale their telehealth fast. Also these virtual provider networks can realize substantial network effects as their scale allows them to smooth out swings in demand.

Specialist e-consult provider networks are another group of telehealth provider networks. These are a bit different, as they are not patient-facing, but are a way for primary care physicians to consult with a specialist to get a more in-depth opinion. The leading e-Consult providers here include Sitka and RubiconMD. They are particularly useful for value based care organizations, as their service might avoid a specialist referral.

It's not about video…

COVID boosted online visits, but telehealth is not just about switching from in-person to video. Adopting digital communication technology drastically reduces the cost of a "doctor visit". Patients don't have to show up in person; visit scheduling becomes easier as geographical restrictions are removed, and "visits" can happen asynchronously. This has further consequences for the delivery of care:

Telehealth breaks the "health care = doctor visit" pattern: As touchpoints with a doctor become much more manageable, this paves the model for continuous care.

Telehealth breaks existing reimbursement patterns: If the "visit" goes away as the primary form of interaction between provider and patient, reimbursement models must adapt. Luckily value-based case models are on the rise, and together with virtual care, this paves the way for more integrated care.

Telehealth breaks existing technology: Many telehealth providers design new care models from scratch. Being digital-first, they need a modern infrastructure supporting their care model. This opens up the chance to build a new stack that takes away the paper burden and allows for a new stack to be created to be more efficient and more automated.

These shifts also have consequences for the technology companies supporting telehealth. Most telehealth communication platforms are pretty commoditized. The differentiation for future health technology vendors is not coming through video capabilities. The next generation of companies will:

Abstract away complicated workflows: A new group is emerging, providing point solutions for specific provider workflows, such as credentialing, prescription fills, etc. These providers usually offer their workflow as APIs that can be integrated into different telehealth tools. I will probably dedicate another article to these products.

Efficiently orchestrated point solutions: These points are only as good as they are coordinated for high-quality patient care. While APIs are great, these products still require efforts to be wired up with other tools. More and more solution providers will emerge that combine workflow APIs into end-to-end services.

Blur the line between providers & technology: Getting the patient, clinician & technology interaction right, and designing good care processes, will be a key differentiating factor. The organizations best equipped to do so will be providers that embrace technology. So we will see more and more the line blur between these types of organizations.

I collected all the digital health providers that I found and put them on website (Digital Care Directory) for your reference. Please reach out if I am missing anyone…