The Value-Based Care Tech Stack - Part I

How tech solutions help with admin and contracting & data analytics

This post is part of a two part series - you can find the second part here.

Value-based care requires a complete rethinking of how we deliver care. And because rethinking is never easy, many provider organizations are still hesitant to take on risk. They often fear they do not have the tools and capabilities in place to reduce cost while maintaining high-quality outcomes. But luckily, there is a whole industry of companies emerging, helping provider organizations adopt value-based care models.

It is a confusing space, though! The scope of vendors are not clear cut, and their websites are full of marketing promises - technology blends with consulting, companies saying they are an end-to-end solution but then also partner with other vendors... It's pretty convoluted. So in today's post, I want to structure this market a bit and look at the different areas where vendors are trying to help providers adopt value-based payment models. As a rough structure, I will be looking at the following areas:

Admin & Contracting support: How to get started?

Data & Analytics: What to do?

Provider Enablement: Get the provider to do it!

Patient Engagement: Get the patient to do it!

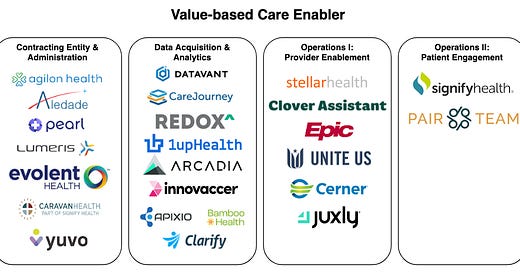

Here is an overview of players in this market.

This map should not be a complete representation of all players in the market (there are so many) but should list a few example companies for each category. Most of the companies here also blend into other parts of the value-based care stack, but I assigned them to their strongest category. If I missed a company, please reach out, and I will include them in the picture.

Getting into Contract: Admin & Contracting Entities

Value-based payment models are a prolific breed, so it makes sense to first look at the different types of models. This is probably the best report on the current state of VBPM adoption, and they provide a great categorization of value-based payment models:

Quality Bonuses: This is basically a payout to the provider if they hit certain quality metrics, such as readmission rates or percentage of patients that came in for an annual wellness exam.

Claim-based (upside, upside & downside): in these models, every provider will be measured against a cost & utilization benchmark, usually calculated using historical claims data. They can be designed as upside-only, which means that the provider will get a share of the savings they have realized but won't have to pay out any money if they miss the benchmark. For upside & downside models, the provider will have to pay out money if they did not meet the benchmark.

Capitation-based: Capitation models take value-based care one step further, and providers will get a lump sum of money every month for every member attributed to their organization. These capitation rates are usually risk-adjusted, meaning the provider will get a higher monthly rate for sicker members than for healthy members.

Each of payment program will most likely only cover a subset of the population the provider sees. So the provider will need to choose which programs are worth joining. CMS alone lists more than 11 value-based care programs for Medicare. For Medicaid, the situation becomes even more complex as it is administered on a state level, and every state defines different value-based payment programs. As value-based care is not a "one-man-show", providers will need to collaborate in order to realize better outcomes. Therefore value-based payment models often require providers to set up a dedicated contracting entity, e.g., an Accountable Care Organization, where a group of providers can collaborate and share their savings. A whole group of companies is supporting providers to become part of these VBPMs and help with the legal and administrative work involved to get into contract. One can categorize these companies by the programs they are targeting. Here are a few examples:

Medicare Direct Contracting: Agilon & Pearl health

Medicare Shared Savings Program: Lumeris, Evolent, Aledade & Caravan

Medicaid VBPM Programs: Yuvo Health

These admin & contracting enablers primarily target smaller practices and clinics, as these providers often don't have the legal resources. Interestingly, some of these providers are reusing the established contracting entities to participate in different value-based care contracts. For example, an Aledade ACO might participate in the Medicare Shared Savings Program and also get in a value-based care program with a Medicare Advantage plan and potentially even a commercial plan. Although admittedly, VBPM adoption in the commercial space has been relatively sluggish.

What should I do now? Data, Analytics & Opportunities

Once a provider is under a contract, the provider will need to work on realizing more cost-efficient care. A major factor here is good data analytics that guides concrete actions a provider can take to improve care quality by reducing costs. Here are a few examples of how data is used to inform steps that can improve outcomes:

Reduce utilization through care coordination & integration: This is probably the most crucial area to improve care. This includes ensuring chronic diseases are well managed, avoiding duplicative care, and appropriate drug utilization. Another example is the post-acute care workflow. To avoid readmissions and fast recovery, the VBC provider needs to address any underlying reasons for hospital admissions. In addition, follow-up care needs to be delivered, and patient context needs to be shared between the hospital, specialists, nursing facilities, and the primary care doctor.

Preventative care & quality metrics: Avoiding costly acute episodes (think emergency room & hospital) and focusing on preventive care can reduce costs in the long term. To also provide short-term incentives for preventative care, many VBPMs come with quality metrics that will give a bonus to the provider if they can meet these requirements. These quality metrics are also crucial for health plans, as they affect their star rating. Medicare Advantage plans and individual market plans use these ratings as marketing tools to attract more members. Thus, they are even more willing to incentivize providers to improve their quality scores. [At least once incentives are aligned...]

Cost-efficient referrals: Routing patients to the most cost-efficient specialists and facilities is another area for realizing value. Unfortunately, cost and quality are usually not correlated in US health care, so making wise decisions in the referral process can significantly affect overall costs. For example, sending a patient to a high-quality imaging center instead of a hospital can bring their radiology cost down from $4000 down to $800.

Risk Coding & Reporting: This is less on the cost side than the revenue side. If a provider is in a capitation program, they will need to report the risk scores of their members. Being diligent in this process has a significant impact on revenue. You can read more about how this works in the risk adjustment article.

All these areas will require robust data sources and a strong data infrastructure to handle the analytics.

Data Sources & Acquisition

Bulls*** in, bulls*** out! This is a truism for any data analysis. So the first step for successful VBC analytics is getting access to the right data sources. Traditionally health care data has been a bit of a nightmare when it comes to accessibility. Even within an organization, not even talking about getting external data sources. However, several vendors are now helping to get this step done for the provider organization. Let's go through the main data sources:

Internal EHR data: This is the apparent data source any VBC provider should start with. Vendors such as Redox can make this data available so providers can push it into population analytics platforms.

External EHR data: However, in order to get a complete view of a patient, it is important to obtain data from other provider organizations as well. This can either be done via health data exchanges, but there are also vendors like Datavant (who acquired Ciox) that allow for chart retrieval from various organizations.

Real-time admission & discharge data: Vendor chart data can have a time lag. Thus, some vendors specialized in providing near real-time data for specific events using ADT (admission, discharge, transfer) data feeds from hospital EHRs. Bamboo health (who acquired PatientPing) is an example here. This data is essential for timely care coordination.

Payer data: Payers have a lot of interesting data, too. Claims are probably the most prominent data source, but health plans can also provide interesting analytics around suspected diagnosis, risk gaps, and population health. While claims are don't offer as much "depth" as medical records, they can provide more "breadth" as they can give a complete historical picture of what happened across care organizations. Claims might also indicate which data from other provider organizations need to be obtained. 1Up.health is a vendor here, facilitating this data exchange.

Provider benchmarks: Provider benchmark data is even broader than payer data, as a good benchmark draws data from different payers. This data gives indications about which providers are cost-effective and have a high quality of care. Several organizations have specialized in providing this type of information and aggregating it across payers. Examples here include CareJourney and Ribbon Health.

Other sources: New data sources are emerging for value-based care use cases. A great example here is data sources around social determinants of health - information about educational background, food security, access to transportation, etc. - will be much more important moving forward. The adoption of social determinant metrics is also driven by the new CDC regulations around the direct contracting program now called REACH (a value-based payment model in Medicare).

Data integration & preparation

Getting access to all the data sources is just the first step in turning data into actionable insights. The data needs to be turned into a usable format in a second step. Several challenges in preparing the data exist here - some examples include:

Technical Barriers: Data might come in very cryptic formats. I've heard of one provider organization that would get some payer data in a corrupted 2001 Excel file that could not be opened on any computer they had. The plan did not have the resources to update the file, so the provider had to build an extractor that could handle this file.

Logic Variation: Even if data comes in formats that can be processed, data comes in different data schemas. Examples here are patient identifiers that don't match across records or business logic that varies across EHR files. The FHIR data model should alleviate some of these paint points here. Still, even in a world of a single data schema, organizations might fill the schema with different data assumptions.

Time Lag: Data can have a significant time lag. This is especially true for claims data, which can take several months to settle. Therefore time gaps might need to be closed using projections or extrapolations from incomplete data.

Noise: Most health care data is high noise and low signal data. A lot of the information in medical records is boilerplate code, and there are instances where the EHR can contain 20,000 (!) record pages for a single patient. Filtering out the signal from the noise is a challenging task.

Because of these challenges, value-based providers need to invest significant resources into their data preparation and integration stack. Some vendors helping with data integration are Innovaccer, Arcadia, Ursa and Edifacs.

Analysis & Continuous Learning

Once the data is integrated into a usable data schema, the interesting part can begin: Turning data into action. For some use cases, the data can be used directly for decision-making. Having a clear metric can drive a lot of decisions. For example, a risk-adjusted cost metric could decide which providers should be preferred for referrals. Other use cases require more complex modeling and analysis. Here are two examples:

Population stratification: In this use case, the provider creates a risk model for their patients to predict specific health outcomes. They can then use this model to assign patients into different risk groups. These risk groups can then help assign them to certain special programs to prevent negative health outcomes.

Intervention evaluation: We still early in value-based care, and there are a lot of interesting approaches providers can take to improve the health of their patients, like home visits, remote patient monitoring programs, and leveraging digital health providers. However, these interventions need to be constantly evaluated, and using the available data is a critical use case here.

A whole group of software vendors, consulting firms, and actuarial firms help providers with their risk modeling and data analytics. Examples include Clarify, Milliman, and many of the larger consulting firms. Also, the major EHR vendors have their population health analytics tools that give providers actionable insights.

My Thoughts on this space...

Actually, I will keep them for the next part. Part two will cover how different companies help turn the insights into actions by supporting providers on the operation side. You can read it here.