Why We Stopped Selling to Incumbents

From Prototype to Live Product in 70 Days: How Arlo Builds Differently in Health Care

If you’ve ever tried to build in healthcare, you know the feeling: the endless sales cycles, the struggle to drive meaningful change, and how partnerships with large incumbents can slow your product release cycles to a crawl. We’ve been there too—but we found another way. This is a story of how building in healthcare can be different.

Before Arlo became a full-stack health insurance for small and mid-sized businesses, Karthik and I set out to improve the member experience through a care navigation solution. We tried hard selling it to incumbent health plans. But even with so-called “modern” plans, it felt like walking through glue. At one point, we found ourselves on a Zoom with an incumbent carrier organization, pitching to a group of 20 VPs—each of whom wanted a say in shaping the member experience. The proposed pilot start date - 4 months out.

That’s not a model for change. It’s a model for preserving the status quo: no risk-taking, no rocking the boat, just incremental improvements at the margins.

And while carriers only are really interested in solutions that do incremental improvements, at the same time they complain about “point solution fatigue” - when really, they should call it what it is: innovation blocking. These organizations are too big, with too many stakeholders to satisfy, too many legacy business models to protect, and no organizational or technical capacity to drive real change.

But healthcare needs change. There’s so much broken—and so much opportunity to make health insurance not a completely miserable experience:

Insurance should offer peace of mind - yet when you go to the doctor, you have no idea if it’ll cost $100 or $2,000.

Benefit designs are confusing. (Do you really know the difference between coinsurance, deductible, and copay? Most people don’t.)

Health plans have outsourced member service to HR teams and brokers—carrier helplines are of little use when issues arise.

So we knew that if we wanted to move beyond incremental change, we had to think bigger. That’s exactly what we did.

Over the past two years, we’ve been building the foundation for continuous innovation at Arlo. We invested in the technology and underwriting platform needed to launch new kinds of products - quickly, sustainably, and with the flexibility to evolve them over time.

It hasn’t been easy. Building mission-critical insurance infrastructure from scratch is quite different from the typical YC-style iteration loop, where you get fast, and immediate feedback from customers whether you’re on the right track or not. And getting brokers and employers to trust a new player in something as critical as health insurance takes time. After all, they are putting the livelihood of their employees in our hands. I’ll never forget standing on a golf course, mimosa in hand, trying to convince brokers about Arlo - only to watch them drive off in their cart with their BUCA carrier rep in the same foursome.

But our bet is paying off. By doing the hard things first - owning the critical parts of the stack end to end and laying the right foundation - we’ve set ourselves up to move fast when it matters. We are now not just a point solution selling to incumbents, but directly competing with United Health Care, Aetna and Blue Cross Blue Shield. We can now move at a speed, that these organizations just can’t.

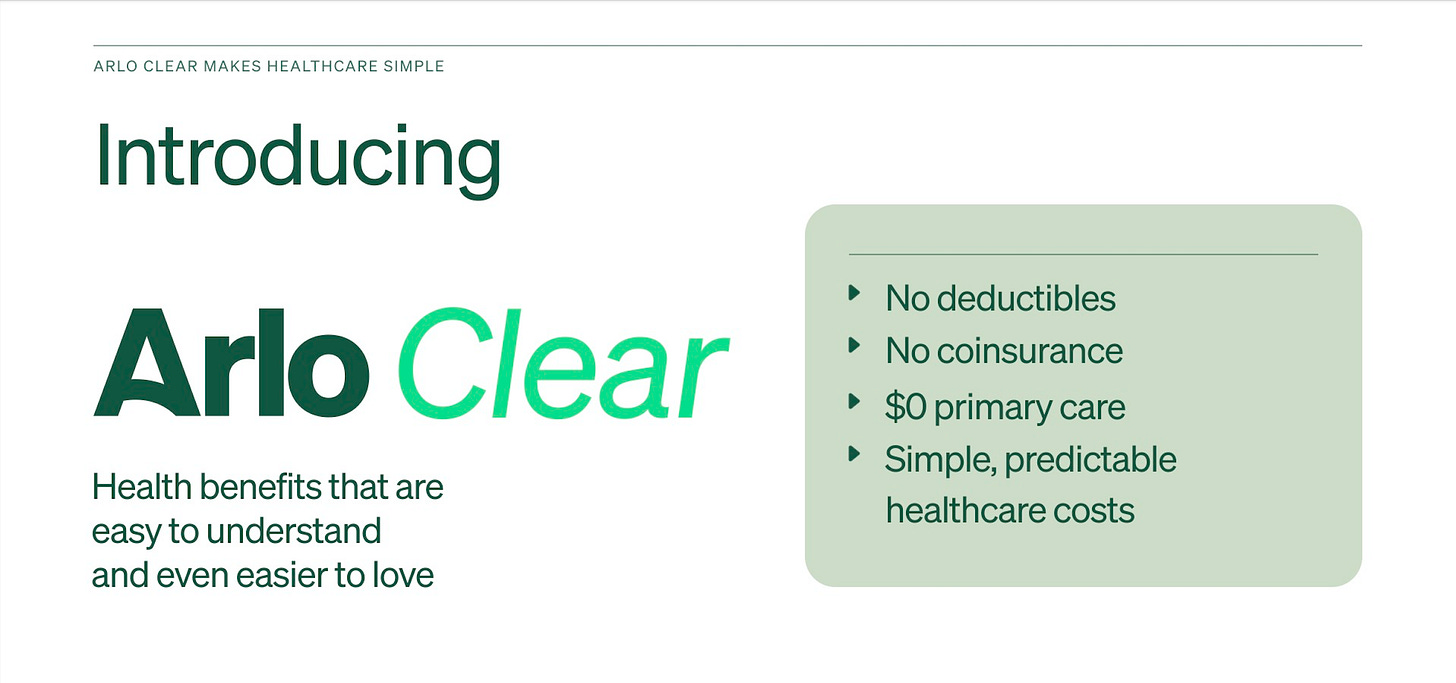

Take Arlo Clear as an example. It began with a simple question: what if we could remove the financial uncertainty people face when they go to the doctor? Our members told us this was one of their biggest concerns, so we built a product around it:

In one week, we created a prototype and completed the actuarial analysis to ensure pricing sustainability

We brought the idea to brokers and employers to gather feedback.

We iterated on the concept and, after another round of feedback, saw clear demand.

Within weeks, we made the necessary operational changes, added it to our quoting portal, and launched a sales campaign.

Just 10 weeks after the initial idea, we’re going live with our first Arlo Clear customers - faster than many software product launches.

I’m so proud of the team that made this possible. Huge shoutout to Sean, our Head of Actuary, and Tanmay, our Head of Health Plan Product. They moved mountains.

We’re not held back by outdated tech, bloated org structures, or the need to protect a legacy business model. That’s our superpower.

And Arlo Clear is just the beginning. We believe AI will fundamentally reshape how people interact with the healthcare system—and what insurance will look like. We’re ready to rapidly deploy what’s next. Stay tuned—we’ve got more exciting launches in the pipeline.

We’re building Arlo into a place where things actually get done in healthcare. If you’re tired of bureaucracy, tired of meetings about meetings, and tired of watching good ideas die in committee - Arlo is different.

You can help reshape healthcare here - and see the results in weeks, not years. Come join us. We’re just getting started.

Ladies and gentlemen, he's BACK